Multi-Class Mobile Money Service Financial Fraud Detection by Integrating Supervised Learning with Adversarial Autoencoders

Photo by Authors

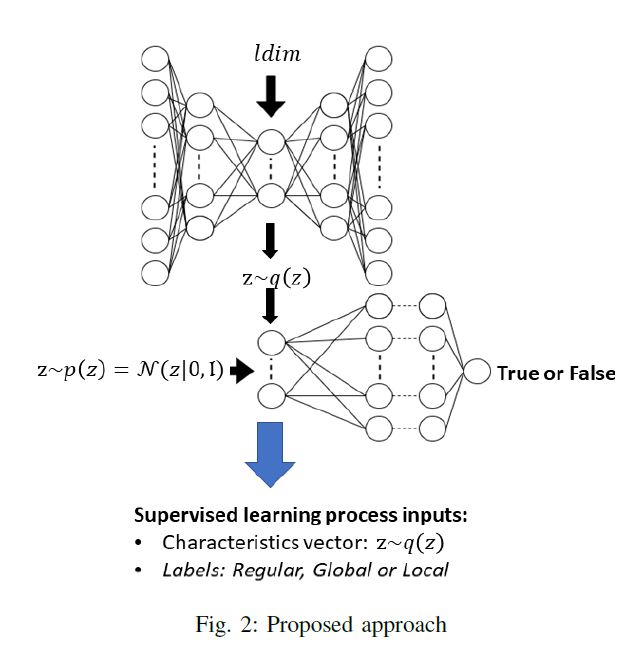

Photo by AuthorsGiven the actual volume and speed of financial transactions, financial fraud detection systems are constantly evolving based on new computational intelligence algorithms. Therefore, transaction monitoring and analysis prevent monetary losses caused by fraudsters. Since the fraud detection process is a labor-intensive task for human auditors given the huge amount of daily transactions processed by financial services information systems. Credit card is the financial product most explored in the financial fraud detection literature, while mobile money service is becoming a popular option for payments, fraud detection for such financial product has not yet been deeply explored. Therefore, it is interesting to optimize the auditing process and test new quantitative techniques, such as deep learning, to support human auditors before double-checking a suspicious transaction. Thus, we propose an integration of adversarial autoencoders and machine learning methods to perform an objective classification among three transaction types: regular, local, and global anomaly. The integration consists of using the autoencoder’s generated latent vectors as features for the supervised learning algorithms. The experiments considered different latent vector space forms concerning their dimensionality and the clusters generated by a prior Gaussian mixture. The results show that some classifiers may accept latent characteristics well, getting better or similar performance when using all the original characteristics.